2020.11.19 CoStone Capital Views:

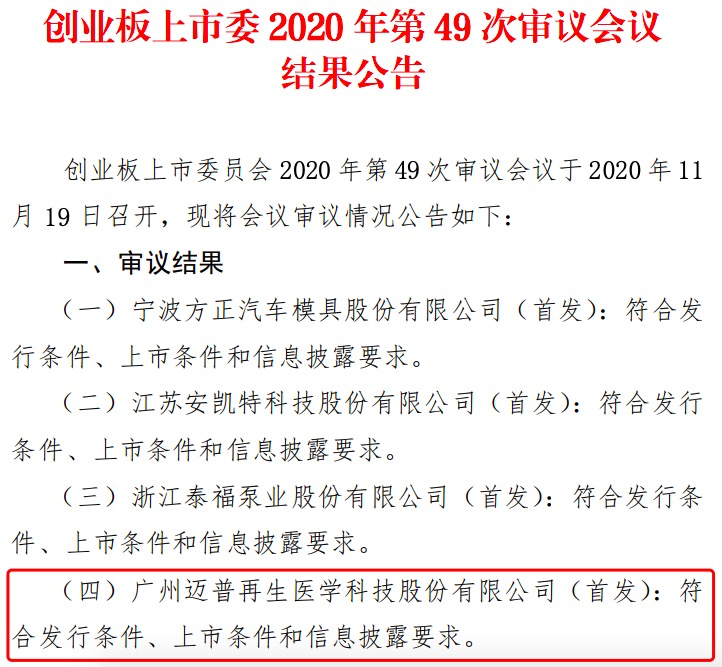

On November 19, the IPO application of MEDPRIN(ipo 108577), one of CoStone Capital’s investment project, was approved by GEM Listing Committee. With Anhui Huaheng Biotechnology(831088) passed CSRC approval on November 17, CoStone has two companies launching IPO this week.

Founded in September 2008, Medprin Regenerative Medical Technologies Co., Ltd. is a high&new technology enterprise dedicated to developing advanced implantable medical devices using cutting-edge manufacturing technology based on the characteristics of synthetic material.

As of the prospectus is signed, Medprin has acquired the approved registration of 3 Class III and 1 Class II medical devices, set up file for 1 Class I medical device product, and obtained CE and CE Design certificates for 3 products. Its absorbable hemostatic yarn is pending for domestic registration approval, and its absorbable medical glue and absorbable oral repair film are in clinical trials. Medprin’s business scope covers many departments such as neurosurgery and stomatology, and it has also established a global marketing system. As of March 31, 2020, Medprin has established cooperation with more than 400 distributors at home and abroad, and its products have been used by more than 600 domestic hospitals. Medprin’s international market covers more than 70 countries and regions including Europe, South America, Asia, and Africa with more than 200,000 clinical cases.

Yuan Yuyu, Founder of Medprin, being interviewed by CCTV

Fortune Magzine editor in chief, Clifton Leaf visited Medprin and wrote an article, in which he said:

Vision of Medprin

Yuan Yuyu, founder of Medprin, said that in the future, innovative SMEs has a promising market potential in fields like personalized precision medicine and personalized reconstructions of human tissues and organs.

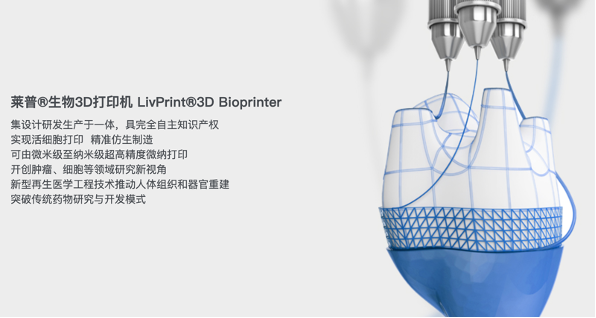

“We are trying to become the Johnson & Johnson of China.” According to Yuan, 3D Bioprinter is a technology that laid the foundation for Medprin. Starting from there, Medprin aspires to extend its business to a larger market of medical equipment.

LivPrint 3D Bioprinter independently developed by Medprin

Ushering in a new chapter

On November 19, 2020, the IPO application of Medprin(ipo 108577) was approved by GEM Listing Committee, giving its investor, CoStone, the second listed company this week after Anhui Huaheng Biotechnology(831088).

According to CoStone, Medprin has started from neurosurgery and made innovative exploration to industrialize the 3D Bioprinting technology. The company has a professional, efficient and visionary team, and it has been aiming for the global market since the designing of its first competitive product, ReDura. In the future, the company plans to extend business into personalized craniofacial jaw repairing and tension-free incontinence slings. Medprin will continue to “print life”, and further commit itself to personalized reconstruction of tissues and organs.

Rewritten by Xue Guanda, Edited by Du Zhixin, Wei Yiyi

The year 2019 marks the fortieth anniversary of China’s Reform &Opening-Up, once again, we meet at the turning point of history. What’s the next step for the game, is there any clear guidance? The answer is affirmative.

Our country is enjoying a good momentum of development, which does not come from the Washington Consensus nor the Beijing Consensus. China’s experience has proved that both the visible hand and the invisible hand are crucial: the visible hand, stands for the government-led reform, and would yield benefits for reform and opening up; the invisible hand, stands for the Marginal Power represented by the private sector, and would improve economic efficiency and tax collection, create jobs and employment opportunities.

Provided that we want to protect and expand the benefits form reform, three simple but mandatory agreements are to be made and followed: No.1 Private ownership must be recognized, protected and treated equally with public ownership constitutionally, both ownerships are scared and inviolable;No.2 Make further clarification of the principal position of market economy, “deepen economic system reform by centering on the decisive role of the market in allocating resources”, as President Xi addressed in the third Plenary Session of the 18th CPC Central Committee;No.3 Implement the guiding principles of “comprehensively promoting law-based governance” of the fourth plenum. The rule of law is essential for economic growth, irreplaceable to protect private ownership, and necessary to encourage innovation and entrepreneurship.

Above are three rules for us to avoid falling into the Middle-income Trap. Assuming that we are breaking systematic barriers to private enterprises’ participation in market economy, and boosting innovation and entrepreneurship of our society, then we are heading towards a promoting direction. We are marching in the path of light, regardless of the ups and downs of Sino-US relationship, the drop in GDP growth rate, or the monetary policy.

These principals also apply on knowing how better to run a business: don’t be hedged by rules and regulations at the beginning, pay more attention to your survival, and you’ll learn more when you start your second business.

For many years, Huawei has been the only Chinese company on the list of the Top 50 R&D Spenders. Regardless of the economy and its income, what Huawei has been doing is investing in its future, dedicated to R&D, continuously and resolutely. This provisional work underscores Huawei’s accomplishments, making Huawei anindustry leader.

So, there are standard answers on how to run a company,which could be summarized as concentration and professional dedication, continuous investment on innovation and trying harder in R&D. Entrepreneurship is also important, every single company needs entrepreneurs to push aside all obstacles and difficulties, to implement strategies and ideas. We, as investors, are destined to look for such outstanding entrepreneurs and their companies, invest in them and partner with them.

At this key point of history, a country, a company, or asingle individual, will all need to find the right path. Four decades after the Reform and Opening-up, it’s time to learn from our experience and stop “wadding across