2023.06.30 Views:

Anhui XDLK Microsystem Corporation Limited(XDLK), a leading domestic MEMS inertial sensor company, has been listed on the scientific and technological innovation board (STAR Market) during the last day of the first half of 2023. By the time the market closed, its stock price had risen by 75.21%, resulting in a market capitalization of 18.74 billion yuan.

XDLK's primary products are high-performance MEMS inertial sensors.

Currently, a few international giants dominate the global MEMS inertial sensor market. XDLK stands out as one of the few companies capable of achieving stable mass production of high-performance MEMS inertial sensors. The company's high-performance MEMS inertial sensors possess advantages such as miniaturization, high integration, and low cost. Its core performance indicators have reached international advanced levels, exhibiting strong adaptability in complex environments. As a result, XDLK holds a certain industry position in the market competition of MEMS inertial sensors.

Unlike low- to medium-performance MEMS inertial sensors mainly applied in consumer electronics and other fields, XDLK's high-performance MEMS inertial sensor products have achieved large-scale applications in China's high-end industry, unmanned systems, and high-reliability fields. These products have innovatively addressed the technical and application challenges in the field of MEMS inertial sensors and have become the major supporting product suppliers for key projects of their clients.

Therefore,in comparison to selected A-share companies in the same industry, XDLK ossesses significant advantages in its gross profit margin. From 2020 to 2022, the average gross profit margin range of the former was 38.66%-46.04%, while XDLK reached as high as 85.47%-88.25%.

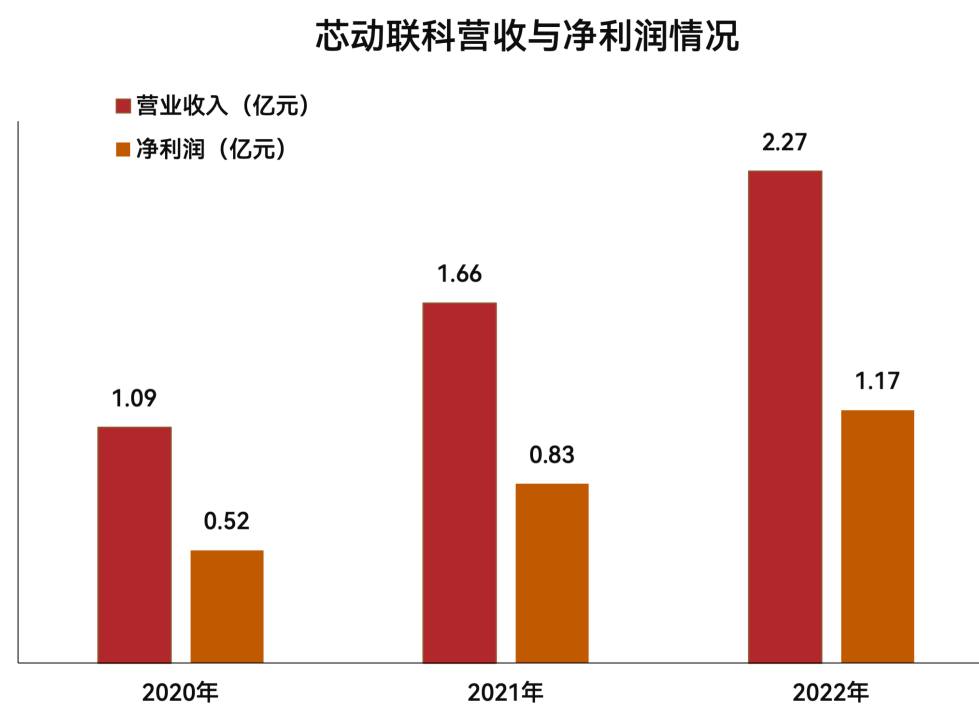

From 2020 to 2022, XDLK's operating revenue grew from 109 million yuan to 227 million yuan, and net profit increased from 52 million yuan to 117 million yuan, with respective compound annual growth rates of 44.54% and 49.89%.

XDLK attaches great importance to its technological research and development. During the reporting period, the company's cumulative R&D investment reached 122.2758 million yuan, accounting for 24.38% of its operating revenue.

In 2021, the company was included in the third batch of the Ministry of Industry and Information Technology's "Specialized, Refined, Unique, and New" (SRUN) small and medium-sized enterprise list. In 2022, it was selected as a champion cultivation enterprise in the manufacturing industry of Anhui Province and received the title of "Top 50 Specialized, Refined, Unique, and New Enterprises" in Anhui Province. The company's technological strength, research achievements, and industrialization capabilities have been recognized by nation and society.

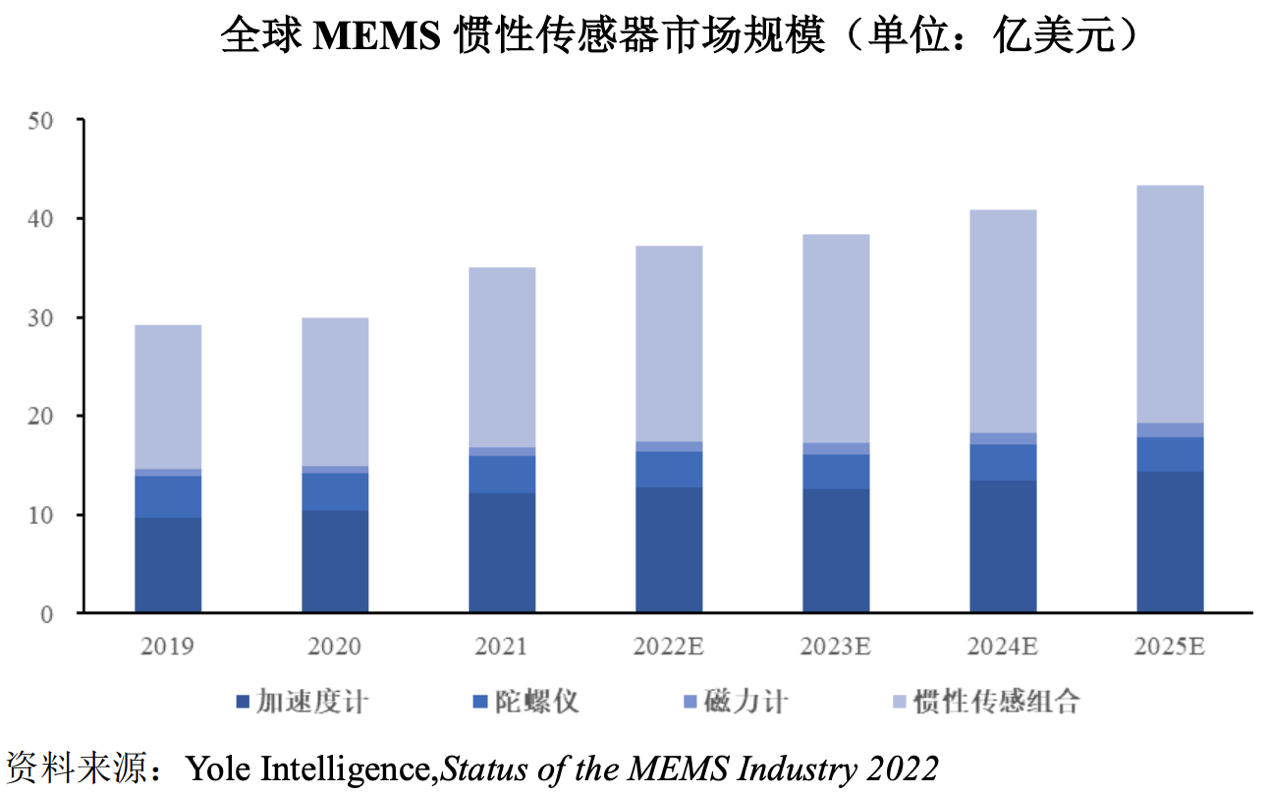

According to Yole's statistics, the global MEMS inertial sensor market reached 3.509 billion USD in 2021 and is projected to reach 4.339 billion USD in 2025.

In the domestic market, according to the "2022 Overview of China's MEMS Sensor Industry" published by LeadLeo, the market size of China's MEMS inertial sensor industry was approximately 13.6 billion yuan in 2021.

With the development of MEMS inertial sensor technology and the expansion of downstream applications such as 5G communication, Industry 4.0, aerospace, and autonomous driving, high-end MEMS sensor companies like XDLK will have broad market space and favorable development opportunities.

CoStone Capital believes that XDLK is a leading domestic semiconductor microsystem sensor chip manufacturer, with its products widely applied in a great many industries such as intelligent automobiles and high-end industrial equipment. The company's core team has accumulated extensive experience in the semiconductor industry. XDLK is also one of CoStone Capital's important deployments in the entire semiconductor industry chain, and we look forward to its further progress after going public!

The year 2019 marks the fortieth anniversary of China’s Reform &Opening-Up, once again, we meet at the turning point of history. What’s the next step for the game, is there any clear guidance? The answer is affirmative.

Our country is enjoying a good momentum of development, which does not come from the Washington Consensus nor the Beijing Consensus. China’s experience has proved that both the visible hand and the invisible hand are crucial: the visible hand, stands for the government-led reform, and would yield benefits for reform and opening up; the invisible hand, stands for the Marginal Power represented by the private sector, and would improve economic efficiency and tax collection, create jobs and employment opportunities.

Provided that we want to protect and expand the benefits form reform, three simple but mandatory agreements are to be made and followed: No.1 Private ownership must be recognized, protected and treated equally with public ownership constitutionally, both ownerships are scared and inviolable;No.2 Make further clarification of the principal position of market economy, “deepen economic system reform by centering on the decisive role of the market in allocating resources”, as President Xi addressed in the third Plenary Session of the 18th CPC Central Committee;No.3 Implement the guiding principles of “comprehensively promoting law-based governance” of the fourth plenum. The rule of law is essential for economic growth, irreplaceable to protect private ownership, and necessary to encourage innovation and entrepreneurship.

Above are three rules for us to avoid falling into the Middle-income Trap. Assuming that we are breaking systematic barriers to private enterprises’ participation in market economy, and boosting innovation and entrepreneurship of our society, then we are heading towards a promoting direction. We are marching in the path of light, regardless of the ups and downs of Sino-US relationship, the drop in GDP growth rate, or the monetary policy.

These principals also apply on knowing how better to run a business: don’t be hedged by rules and regulations at the beginning, pay more attention to your survival, and you’ll learn more when you start your second business.

For many years, Huawei has been the only Chinese company on the list of the Top 50 R&D Spenders. Regardless of the economy and its income, what Huawei has been doing is investing in its future, dedicated to R&D, continuously and resolutely. This provisional work underscores Huawei’s accomplishments, making Huawei anindustry leader.

So, there are standard answers on how to run a company,which could be summarized as concentration and professional dedication, continuous investment on innovation and trying harder in R&D. Entrepreneurship is also important, every single company needs entrepreneurs to push aside all obstacles and difficulties, to implement strategies and ideas. We, as investors, are destined to look for such outstanding entrepreneurs and their companies, invest in them and partner with them.

At this key point of history, a country, a company, or asingle individual, will all need to find the right path. Four decades after the Reform and Opening-up, it’s time to learn from our experience and stop “wadding across