2012.12.19 Costone Capital Views:

Nowadays, the industry is widely distributed globally, especially in a large economy like China. Although each industry's growth space is huge, it is essential for venture capital firms to choose the industry of the greatest potential during the entrepreneurial process, then investigating the enterprise in the industry and the team in the enterprise. It is the same for an enterprise to choose an industry wisely because many industries have already saturated with limited development opportunities. But we already found some markets in crisis available for future exploration, and many 'hidden champions' in Dongguan probably perform well suddenly.

We have seen a vast of the listed company performed well in a niche market, and we are in purpose of exploring a similar market. Also, it is worthwhile to mention that the correlation between macroeconomy and microeconomy in China is relatively higher than in most countries because the economy is developed with Chinese characteristics. Thus, although investing in the enterprise is mainly based on the micro-level, the investor should also pay attention to the dynamic of macro conditions.

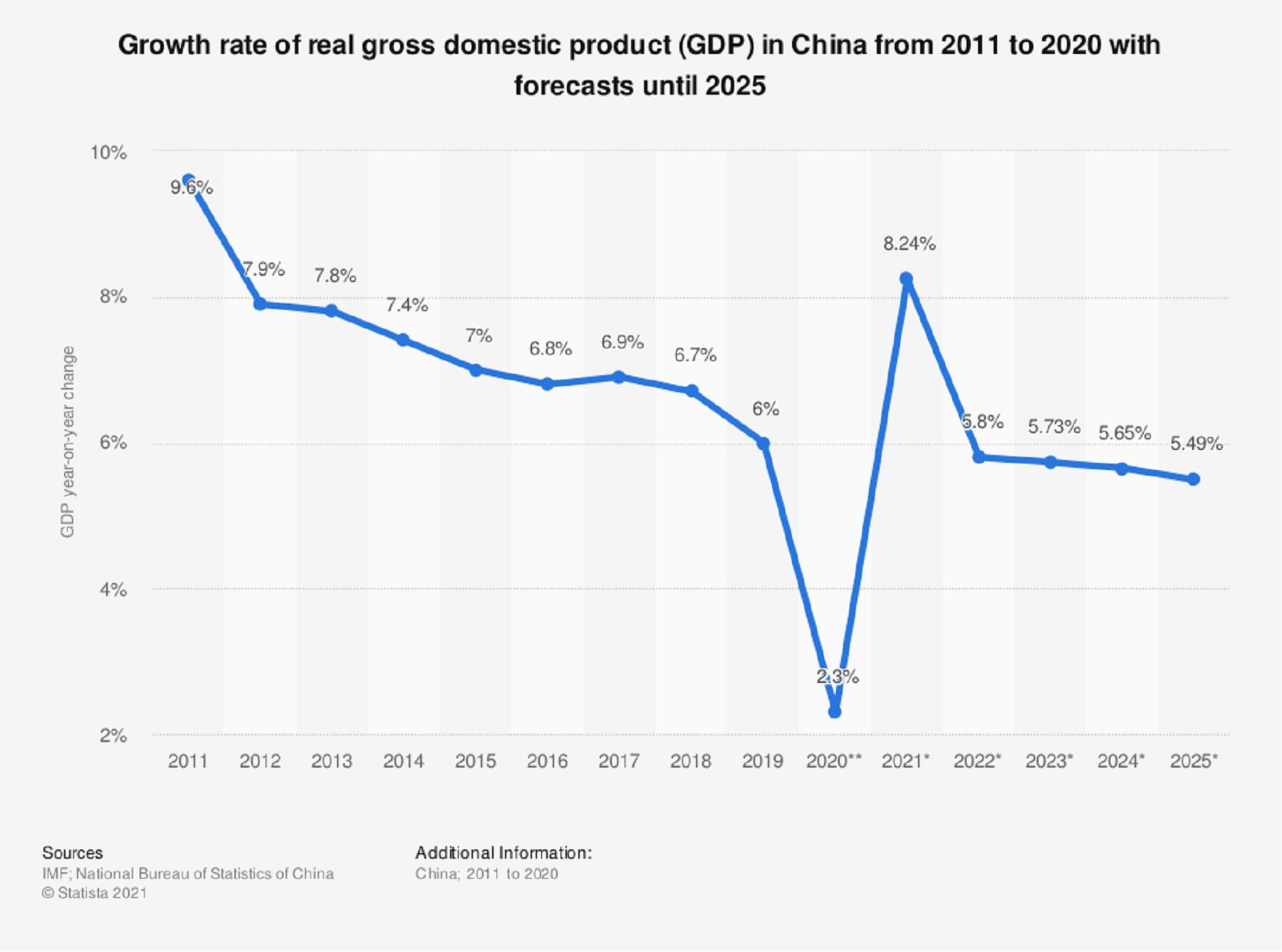

Since the establishment of China, the central government issued a series of policies and reformations, including population growth, opening-up policy, One Belt One Road Initiative, etc., which laid a solid foundation for economic growth. However, the policy dividend has been almost exhausted over around 60 years' development, and it probably indicates the central government will set a new economic structure to stabilize consistent GDP growth. It will be a good opportunity for enterprise development and market investment.

Wang predicted that the Chinese economy is on the left of a U-shaped recovery, and this time would be a good opportunity to enter or invest in good enterprise and emerging market.

Rewritten by: Siyuan, Edited by: Du Zhixin, Li Yunzhen

The year 2019 marks the fortieth anniversary of China’s Reform &Opening-Up, once again, we meet at the turning point of history. What’s the next step for the game, is there any clear guidance? The answer is affirmative.

Our country is enjoying a good momentum of development, which does not come from the Washington Consensus nor the Beijing Consensus. China’s experience has proved that both the visible hand and the invisible hand are crucial: the visible hand, stands for the government-led reform, and would yield benefits for reform and opening up; the invisible hand, stands for the Marginal Power represented by the private sector, and would improve economic efficiency and tax collection, create jobs and employment opportunities.

Provided that we want to protect and expand the benefits form reform, three simple but mandatory agreements are to be made and followed: No.1 Private ownership must be recognized, protected and treated equally with public ownership constitutionally, both ownerships are scared and inviolable;No.2 Make further clarification of the principal position of market economy, “deepen economic system reform by centering on the decisive role of the market in allocating resources”, as President Xi addressed in the third Plenary Session of the 18th CPC Central Committee;No.3 Implement the guiding principles of “comprehensively promoting law-based governance” of the fourth plenum. The rule of law is essential for economic growth, irreplaceable to protect private ownership, and necessary to encourage innovation and entrepreneurship.

Above are three rules for us to avoid falling into the Middle-income Trap. Assuming that we are breaking systematic barriers to private enterprises’ participation in market economy, and boosting innovation and entrepreneurship of our society, then we are heading towards a promoting direction. We are marching in the path of light, regardless of the ups and downs of Sino-US relationship, the drop in GDP growth rate, or the monetary policy.

These principals also apply on knowing how better to run a business: don’t be hedged by rules and regulations at the beginning, pay more attention to your survival, and you’ll learn more when you start your second business.

For many years, Huawei has been the only Chinese company on the list of the Top 50 R&D Spenders. Regardless of the economy and its income, what Huawei has been doing is investing in its future, dedicated to R&D, continuously and resolutely. This provisional work underscores Huawei’s accomplishments, making Huawei anindustry leader.

So, there are standard answers on how to run a company,which could be summarized as concentration and professional dedication, continuous investment on innovation and trying harder in R&D. Entrepreneurship is also important, every single company needs entrepreneurs to push aside all obstacles and difficulties, to implement strategies and ideas. We, as investors, are destined to look for such outstanding entrepreneurs and their companies, invest in them and partner with them.

At this key point of history, a country, a company, or asingle individual, will all need to find the right path. Four decades after the Reform and Opening-up, it’s time to learn from our experience and stop “wadding across