2020.05.22 CoStone Capital Views:

On May 22nd, CHERVON Auto(603982), invested by Co-Stone in 2017, made IPO on Shanghai Stock Exchange. On its first day, the company’s stock achieved a soaring rise of 44%, the limit up of new stock’s IPO.

On May 22nd, CHERVON Auto(603982), invested by Co-Stone in 2017, made IPO on Shanghai Stock Exchange. On its first day, the company’s stock achieved a soaring rise of 44%, the limit up of new stock’s IPO.

Following Vland(603739), CHERVON becomes Co-Stone’s second investment project that made IPO this year.

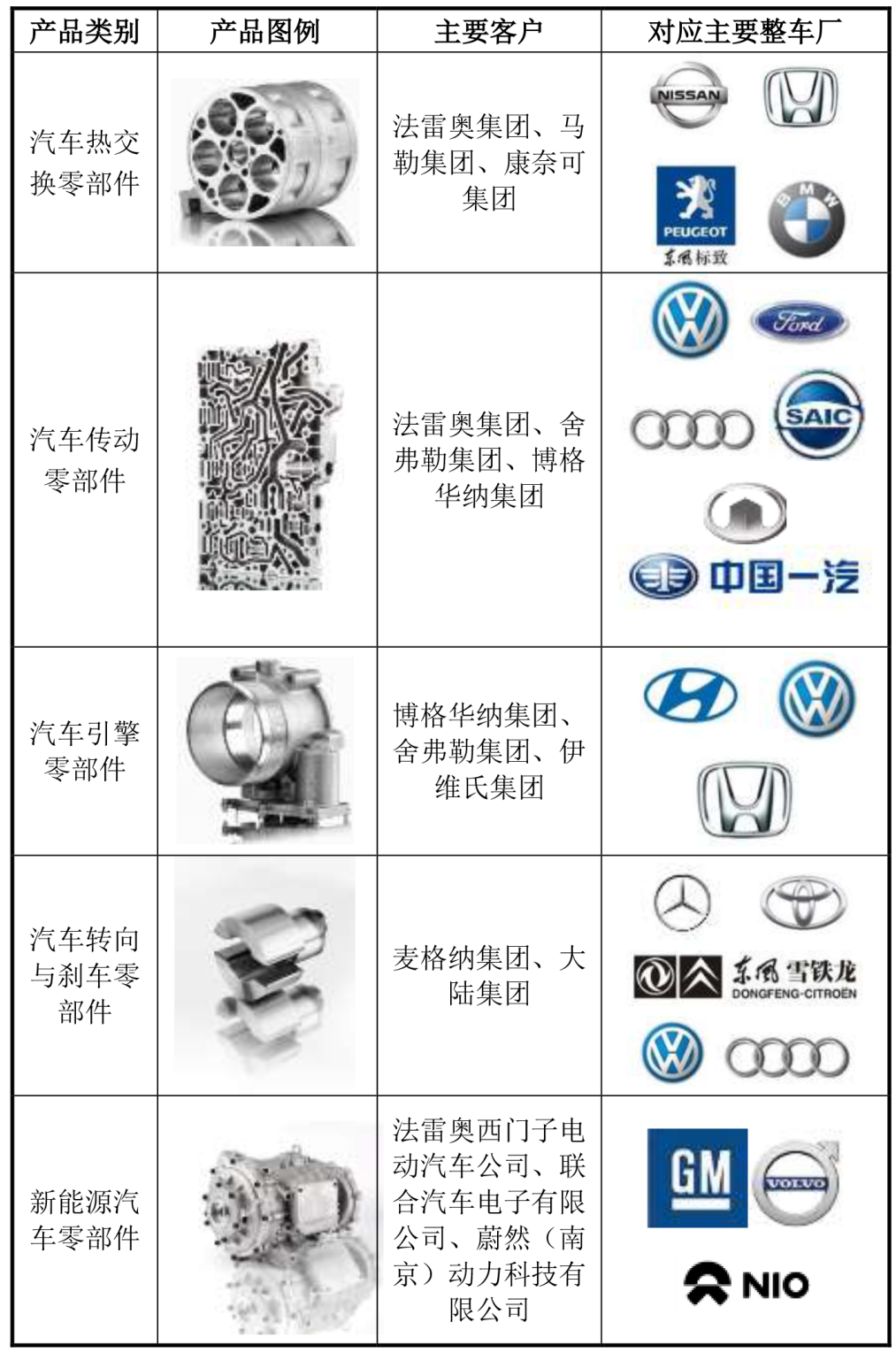

CHERVON Auto’s business scope mainly involves the R&D, production and sale of key automobile spare parts. The company supplies for many major multinational automobile spare part suppliers, and it is seizing the opportunities brought by new energy. CHERVON is growing rapidly, and it has a promising outlook.

Steady Growth

CHERVON’s business engagement with multinational automobile spare part suppliers is shown in the chart below:

CHERVON achieved an annual revenue increase of 26.7% from 2015 to 2018, and a annual net profit increase of 33.41% in the same period.

Promising Potential

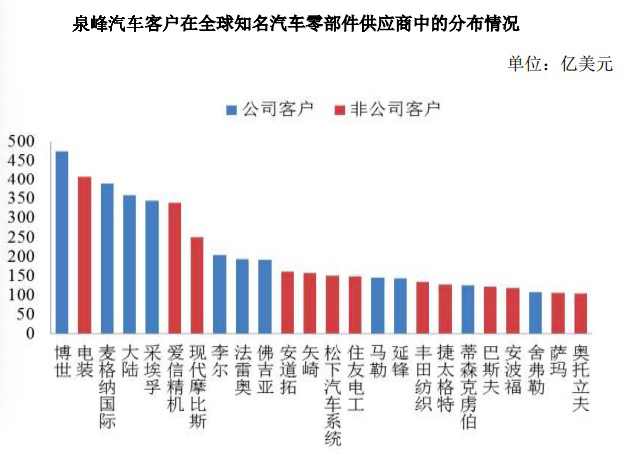

Global automobile market is transforming, major spare part suppliers with technology and capital advantage will be more competitive, and CHERVON’s clients are exactly these primary suppliers.

Chart:Clients Distribution of CHERVON

The development of new energy cars, the trend of energy conserving and environment protection will promote the need of magnalium automobile parts. CHERVON has made breakthroughs in this field, with higher productivity and better quality, the company has increased its gross profit.

From 2015 to 2018, CHERVON has raised its sales revenue of new energy related products from ¥8.7276 million to ¥114.2822 million, with an annual increase of 135.7%, the share of sales revenue has increased from 1.47% in 2015 to 9.51% in 2018.

The funding raised from the IPO will be partly allocated to improve the production capacity of spare parts for new energy cars.

CoStone believes that the future of China’s new energy cars lies in the upstream and downstream of the automobile industrial chain, thus Co-Stone is determined to invest in the industrial chain to search for the next star corporation like Bosch and Aisin Seiki.

CoStone sees the value of CHERVON in the following 3 aspects:

The strong management team with rich international experience led by chairman of CHERVON Auto, Mr. Pan Longquan.

Advanced technology including cutting-edge manufacturing process, prominent mould designing and strong R&D competence.

Constant flow of quality clients.

Currently, CoStone has invested over ¥5 billion in automobile industry. Among these investment projects, five companies, including CHERVON Auto(603982), HUITIAN New Material(300041), XUCHANG YUANDONG Drive Shaft(002406), Huachangda Intelligent Equipment(300278) and SOLING(002766), has made IPO. Meanwhile, Co-Stone has also invested a considerable amount of funding in automobile industrial chain related companies including Lanke Lithium, EFORT, Xcar, Klclear, Grand Auto, ZHONGDING Sealing Parts, HMT, JiangnanMould&PlasticTechnology, Joyson Electronics and Carzone.

Rewritten by: Xue Guanda, Edited by: Du Zhixin, Li Yunzhen

The year 2019 marks the fortieth anniversary of China’s Reform &Opening-Up, once again, we meet at the turning point of history. What’s the next step for the game, is there any clear guidance? The answer is affirmative.

Our country is enjoying a good momentum of development, which does not come from the Washington Consensus nor the Beijing Consensus. China’s experience has proved that both the visible hand and the invisible hand are crucial: the visible hand, stands for the government-led reform, and would yield benefits for reform and opening up; the invisible hand, stands for the Marginal Power represented by the private sector, and would improve economic efficiency and tax collection, create jobs and employment opportunities.

Provided that we want to protect and expand the benefits form reform, three simple but mandatory agreements are to be made and followed: No.1 Private ownership must be recognized, protected and treated equally with public ownership constitutionally, both ownerships are scared and inviolable;No.2 Make further clarification of the principal position of market economy, “deepen economic system reform by centering on the decisive role of the market in allocating resources”, as President Xi addressed in the third Plenary Session of the 18th CPC Central Committee;No.3 Implement the guiding principles of “comprehensively promoting law-based governance” of the fourth plenum. The rule of law is essential for economic growth, irreplaceable to protect private ownership, and necessary to encourage innovation and entrepreneurship.

Above are three rules for us to avoid falling into the Middle-income Trap. Assuming that we are breaking systematic barriers to private enterprises’ participation in market economy, and boosting innovation and entrepreneurship of our society, then we are heading towards a promoting direction. We are marching in the path of light, regardless of the ups and downs of Sino-US relationship, the drop in GDP growth rate, or the monetary policy.

These principals also apply on knowing how better to run a business: don’t be hedged by rules and regulations at the beginning, pay more attention to your survival, and you’ll learn more when you start your second business.

For many years, Huawei has been the only Chinese company on the list of the Top 50 R&D Spenders. Regardless of the economy and its income, what Huawei has been doing is investing in its future, dedicated to R&D, continuously and resolutely. This provisional work underscores Huawei’s accomplishments, making Huawei anindustry leader.

So, there are standard answers on how to run a company,which could be summarized as concentration and professional dedication, continuous investment on innovation and trying harder in R&D. Entrepreneurship is also important, every single company needs entrepreneurs to push aside all obstacles and difficulties, to implement strategies and ideas. We, as investors, are destined to look for such outstanding entrepreneurs and their companies, invest in them and partner with them.

At this key point of history, a country, a company, or asingle individual, will all need to find the right path. Four decades after the Reform and Opening-up, it’s time to learn from our experience and stop “wadding across