2018.06.01 Zhang Wei Views:

Reasons behind the rapid growth of unicorns are huge, real demand, a moat around them and advantages of technology and product. But eventually, they have to compete for market share with their management. Unicorns that take the lead in business model are even more unreliable than those that pull ahead in technology because business model is easier to replicate due to the ways they share. Reasonable valuation should also be taken into consideration in an investment. As primary-market investors, we have to evaluate the company’s profitability and potential for growth. If it is overpriced, it’s just a bubble.

Reasons behind the rapid growth of unicorns are huge, real demand, a moat around them and advantages of technology and product. But eventually, they have to compete for market share with their management. Unicorns that take the lead in business model are even more unreliable than those that pull ahead in technology because business model is easier to replicate due to the ways they share. Reasonable valuation should also be taken into consideration in an investment. As primary-market investors, we have to evaluate the company’s profitability and potential for growth. If it is overpriced, it’s just a bubble.

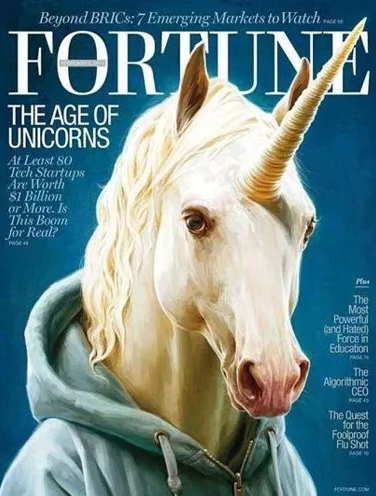

Most unicorns are not new species, but something that is dying or just a pig with a horn projecting from its forehead.

According to international statistics, the three reasons why unicorns fail to pull it off are: a lack of market demand, capital chain rupture and mismanagement.

For instance, the ever-popular smart bracelets maker, Jawbone, was once valued at $3B, and now it has closed. The primary cause of its failure is that its temporary advantage of technology hadn’t widen the gap with its rivals. After all it takes execution capability to quickly dominate the market.

Now the numbers of unicorns are ever-increasing, which says a lot about changes in technology, market and regulatory policies in addition to the liquidity of capital. If there are no new cases of financing or IPO, but a decrease in valuation, it is a bad sign.

CoStone Capital has been sticking to two principles when investing in unicorns: the potential for growth and the reasonable valuation. The potential for growth is assessed from the following three perspectives:

The demand: there are enormous real demand in the related sector with the large-scale market segment, and the company won’t hit the ceiling anytime soon.

The “moat”: they’ve gained competitive advantages of technology and product through consistent financial commitment in R&D; commercial advantages from brand and channel-building; the cost advantage through higher operational efficiency with segmentation of tasks; original creative capability through accumulation of talented pool.

Commercialization: they have the ability to turn above advantages into highly efficient profitability with cashflow to match.

The reasonable valuation is not about the actual value at the moment of trading. It’s more about recovering its value through returns on the rapid growth of corporations and achieving a margin of safety as soon as possible.

On the 6th Chinese Venture Capital Summit held by Securities Times, CoStone Capital Zhang Wei said that becoming a unicorn has become the envy of all startups, but only a few of the “unicorns” can succeed, and most of them have no way out. Access to the full article in Chinese: http://stonevc.com/news_view.aspx?TypeId=4&Id=697&Fid=t2:4:2

Rewritten by Lu Ying; Edited by Li Yunzhen, Du Zhixin

The year 2019 marks the fortieth anniversary of China’s Reform &Opening-Up, once again, we meet at the turning point of history. What’s the next step for the game, is there any clear guidance? The answer is affirmative.

Our country is enjoying a good momentum of development, which does not come from the Washington Consensus nor the Beijing Consensus. China’s experience has proved that both the visible hand and the invisible hand are crucial: the visible hand, stands for the government-led reform, and would yield benefits for reform and opening up; the invisible hand, stands for the Marginal Power represented by the private sector, and would improve economic efficiency and tax collection, create jobs and employment opportunities.

Provided that we want to protect and expand the benefits form reform, three simple but mandatory agreements are to be made and followed: No.1 Private ownership must be recognized, protected and treated equally with public ownership constitutionally, both ownerships are scared and inviolable;No.2 Make further clarification of the principal position of market economy, “deepen economic system reform by centering on the decisive role of the market in allocating resources”, as President Xi addressed in the third Plenary Session of the 18th CPC Central Committee;No.3 Implement the guiding principles of “comprehensively promoting law-based governance” of the fourth plenum. The rule of law is essential for economic growth, irreplaceable to protect private ownership, and necessary to encourage innovation and entrepreneurship.

Above are three rules for us to avoid falling into the Middle-income Trap. Assuming that we are breaking systematic barriers to private enterprises’ participation in market economy, and boosting innovation and entrepreneurship of our society, then we are heading towards a promoting direction. We are marching in the path of light, regardless of the ups and downs of Sino-US relationship, the drop in GDP growth rate, or the monetary policy.

These principals also apply on knowing how better to run a business: don’t be hedged by rules and regulations at the beginning, pay more attention to your survival, and you’ll learn more when you start your second business.

For many years, Huawei has been the only Chinese company on the list of the Top 50 R&D Spenders. Regardless of the economy and its income, what Huawei has been doing is investing in its future, dedicated to R&D, continuously and resolutely. This provisional work underscores Huawei’s accomplishments, making Huawei anindustry leader.

So, there are standard answers on how to run a company,which could be summarized as concentration and professional dedication, continuous investment on innovation and trying harder in R&D. Entrepreneurship is also important, every single company needs entrepreneurs to push aside all obstacles and difficulties, to implement strategies and ideas. We, as investors, are destined to look for such outstanding entrepreneurs and their companies, invest in them and partner with them.

At this key point of history, a country, a company, or asingle individual, will all need to find the right path. Four decades after the Reform and Opening-up, it’s time to learn from our experience and stop “wadding across