On December 11th, Yeahmobi, one of CoStone’s investment portfolio, has been approved for its public listing application by the GEM listing committee. Yeahmobi is an intelligent marketing service provider for corporate internationalization. The company is committed to provide customers with marketing promotion service across the globe. Currently Yeahmobi’s major business involves performance advertising, brand advertising and account management for major medias.

READ

On November 19, the IPO application of MEDPRIN(ipo 108577), one of CoStone Capital’s investment project, was approved by GEM Listing Committee. With Anhui Huaheng Biotechnology(831088) passed CSRC approval on November 17, CoStone has two companies launching IPO this week.

READ

Jean-Marie Lehn, one of the 1987 Nobel Laureates in Chemistry, praised Royole for its distinctive innovation of fully flexible display at the 3rd World Laurates Forum. Scientific research itself, in the eyes of this laureate, resembles Sci-Fi features, but Royole’s flexible human-machine interface (HMI) technology seems a reality directly out of SF novels, the laureate exclaimed after seeing Royole’s achievements.

READ

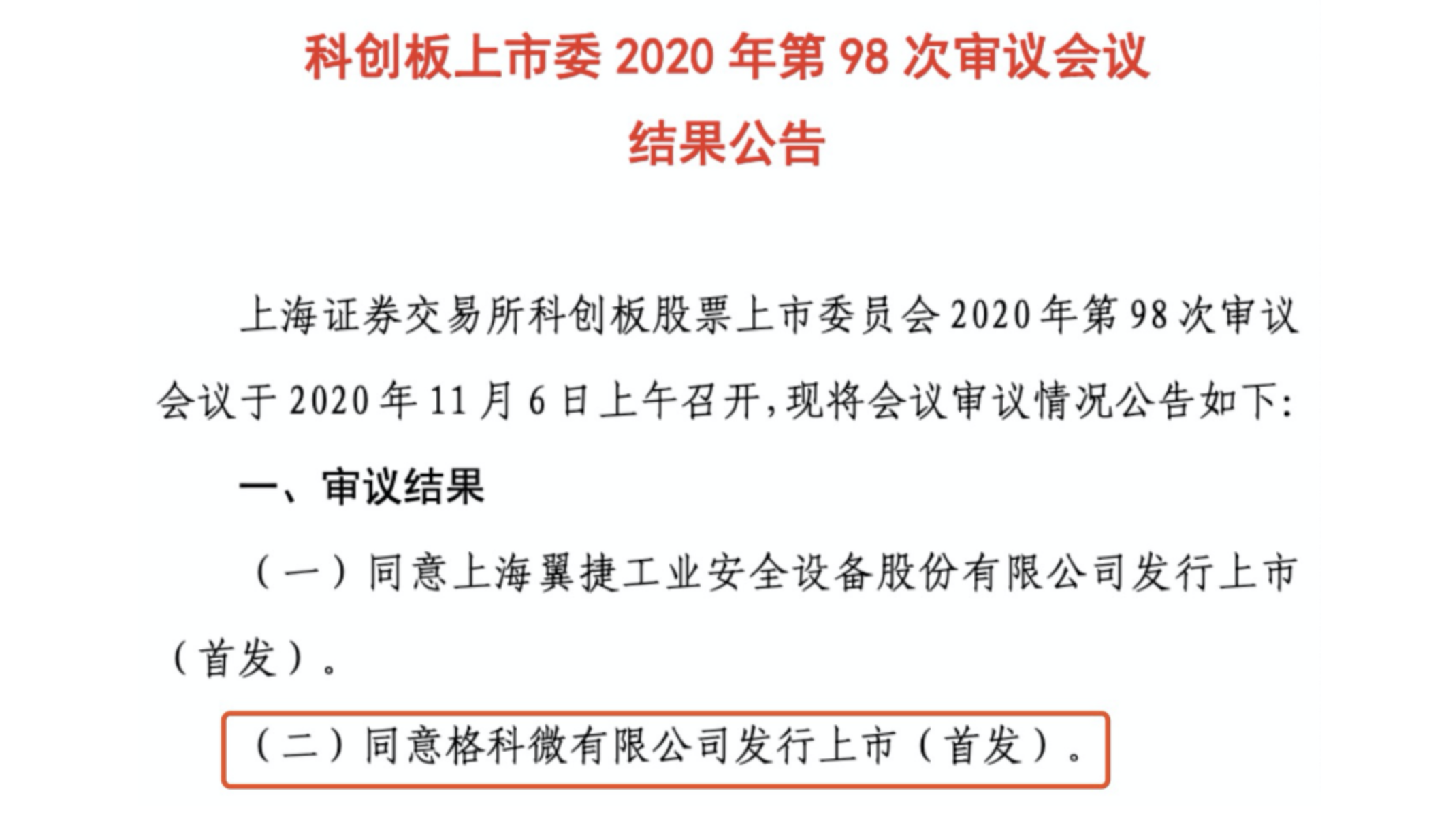

On November 6th, 2020, CoStone Capital’s portfolio company GalaxyCore, a leading Chinese senor maker of CMOS image and DDI display gets approved for its IPO, joining CoStone’s STAR Market portfolio of Effort (688165.SH), SinoMed (688108.SH), BrightGene (688166.SH), Jinhong Gas (688106.SH), Donglai Coating Technology (688129.SH).

READ

SmartMore, a China's AI computer vision solution provider for industrial manufacturing, completed a USD 100 million Series A financing round, becoming the youngest “quasi-unicorn” AI company. CoStone Capital is one of the investors.

READ

October 22th, 2010 marked the Listing Ceremony and Global Dealer Conference of Shenzhen Soling Industrial Co., Ltd., a moment witnessed by Soling’s dealers coming afar. Soling has kicked off its journey of listing after 19-year growth and became a stronger force in the industry which is geared up for a shining future.

READ

August 7th, China’s securities regulator approved the IPO registration of Donglai Coating Technology Co., Ltd. It then will be listed on the Shanghai Stock Exchange's sci-tech innovation board, commonly known as the STAR market, adding a fifth STAR company to CoStone’s portfolio.

READ

On June 16th, 2020, Suzhou Jinhong Gas (688106.SH), one of CoStone’s best portfolio companies, kicked off trading on the Nasdaq-style STAR Market of the Shanghai Stock Exchange (SSE).

READ

Snibe (300832.SZ), Shenzhen New Industries Biomedical Engineering Co., Ltd., a leading Chinese biomedical technology company, sees its price bump up to 24.5 USD/share. It has raised over 10bn USD. In late May, less than two weeks since its IPO, Snibe has attracted 194 renowned Chinese institutional capital managers. This week adds another 24. Over 200 renowned capital managers, by now, have been attracted by Snibe, the newly emerged Prince Charming of China’s A-share market.

READ

Lily & Beauty is the largest one-stop online retailer of beauty products in China and the world’s largest provider of online counters for cosmetic brands.

READThe year 2019 marks the fortieth anniversary of China’s Reform &Opening-Up, once again, we meet at the turning point of history. What’s the next step for the game, is there any clear guidance? The answer is affirmative.

Our country is enjoying a good momentum of development, which does not come from the Washington Consensus nor the Beijing Consensus. China’s experience has proved that both the visible hand and the invisible hand are crucial: the visible hand, stands for the government-led reform, and would yield benefits for reform and opening up; the invisible hand, stands for the Marginal Power represented by the private sector, and would improve economic efficiency and tax collection, create jobs and employment opportunities.

Provided that we want to protect and expand the benefits form reform, three simple but mandatory agreements are to be made and followed: No.1 Private ownership must be recognized, protected and treated equally with public ownership constitutionally, both ownerships are scared and inviolable;No.2 Make further clarification of the principal position of market economy, “deepen economic system reform by centering on the decisive role of the market in allocating resources”, as President Xi addressed in the third Plenary Session of the 18th CPC Central Committee;No.3 Implement the guiding principles of “comprehensively promoting law-based governance” of the fourth plenum. The rule of law is essential for economic growth, irreplaceable to protect private ownership, and necessary to encourage innovation and entrepreneurship.

Above are three rules for us to avoid falling into the Middle-income Trap. Assuming that we are breaking systematic barriers to private enterprises’ participation in market economy, and boosting innovation and entrepreneurship of our society, then we are heading towards a promoting direction. We are marching in the path of light, regardless of the ups and downs of Sino-US relationship, the drop in GDP growth rate, or the monetary policy.

These principals also apply on knowing how better to run a business: don’t be hedged by rules and regulations at the beginning, pay more attention to your survival, and you’ll learn more when you start your second business.

For many years, Huawei has been the only Chinese company on the list of the Top 50 R&D Spenders. Regardless of the economy and its income, what Huawei has been doing is investing in its future, dedicated to R&D, continuously and resolutely. This provisional work underscores Huawei’s accomplishments, making Huawei anindustry leader.

So, there are standard answers on how to run a company,which could be summarized as concentration and professional dedication, continuous investment on innovation and trying harder in R&D. Entrepreneurship is also important, every single company needs entrepreneurs to push aside all obstacles and difficulties, to implement strategies and ideas. We, as investors, are destined to look for such outstanding entrepreneurs and their companies, invest in them and partner with them.

At this key point of history, a country, a company, or asingle individual, will all need to find the right path. Four decades after the Reform and Opening-up, it’s time to learn from our experience and stop “wadding across